Giveaway 2025: Merry Christmas & Happy Holidays!Another year, another stack of charts, lessons learned the hard way, and moments where the market reminded us who’s really in charge.

As 2025 winds down, we want to say a genuine thank you. Your ideas, comments, chart screenshots, hot takes, and valuable feedback are what make TradingView what it i

Your 2025 space mission is here

Suit up and get ready to explore every highlight of your trading galaxy.

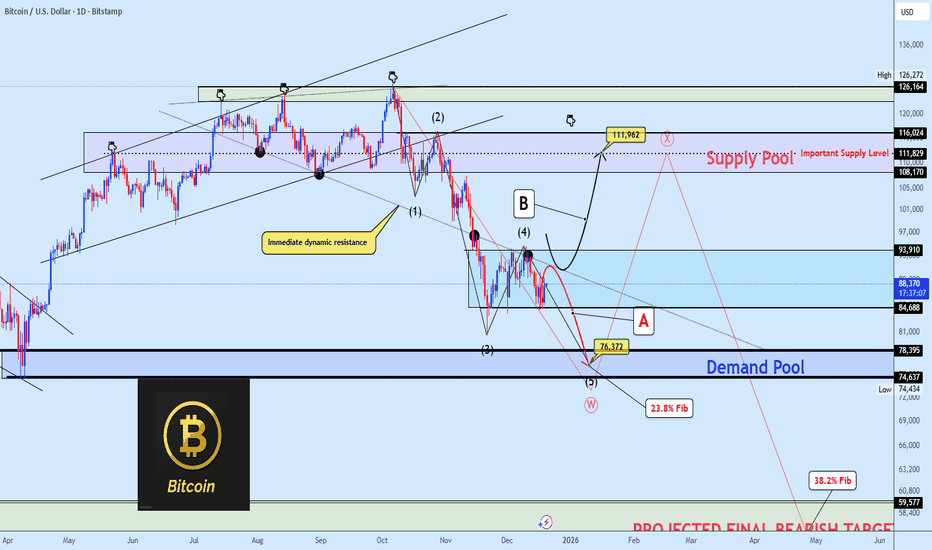

BTCUSDTHello Traders! 👋

What are your thoughts on Bitcoin?

Bitcoin has entered a corrective phase after a strong bearish move and is currently ranging between a clearly defined support and resistance zone. As long as price remains inside this range, no major directional move is expected.

At the moment,

EUR/AUD at a Crossroads!The EUR/AUD pair is trading in an upward trend on the four-hour timeframe following the pullback that took place between November 25 and December 10.

The pair is now at a crossroads between continuing the upward trend from the current support levels at 1.77340 and 1.77154, targeting 1.77792 as the

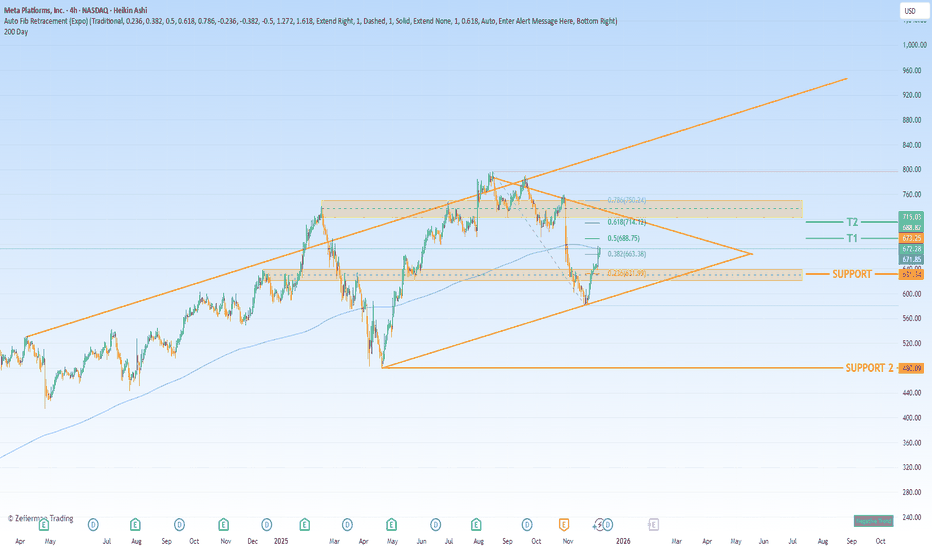

Navigating Volatility Amid Unprecedented Scale and Future InvestNASDAQ:META Meta Platforms, Inc. (META) presents a compelling bullish case rooted in its unparalleled execution within the digital advertising core business, juxtaposed against significant strategic investments in future technologies—investments that, while costly, are funded by immense cash flows

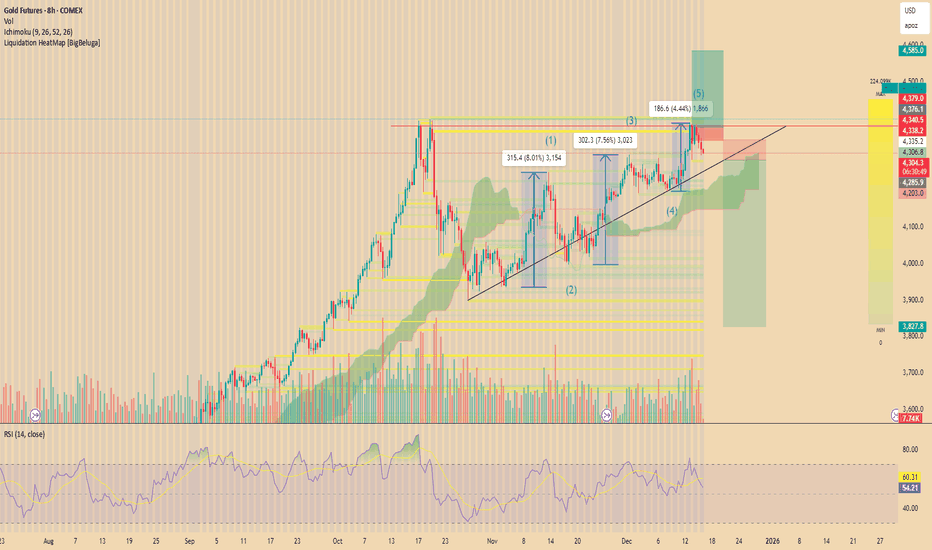

GC(XAU/USD) technical analysis and directional opinion*In this analysis I will not include macroecnomic analysis as we all know broad financial market is waiting for BoJ to create clear directional bias upcoming end of this week on Friday. However I will make a seperate post regarding "How to decode BoJ decision" on the day before the Japanese rate dec

Nasdaq-100: Lower Low and Lower High?The Nasdaq-100 made a lower low, and now it might have made a lower high.

The first pattern on today’s chart is the November 21 low of 23,854, some 353 points below the October trough. That broke a series of higher lows since April.

Second, the tech-heavy index peaked at 25,835 on December 10. Tha

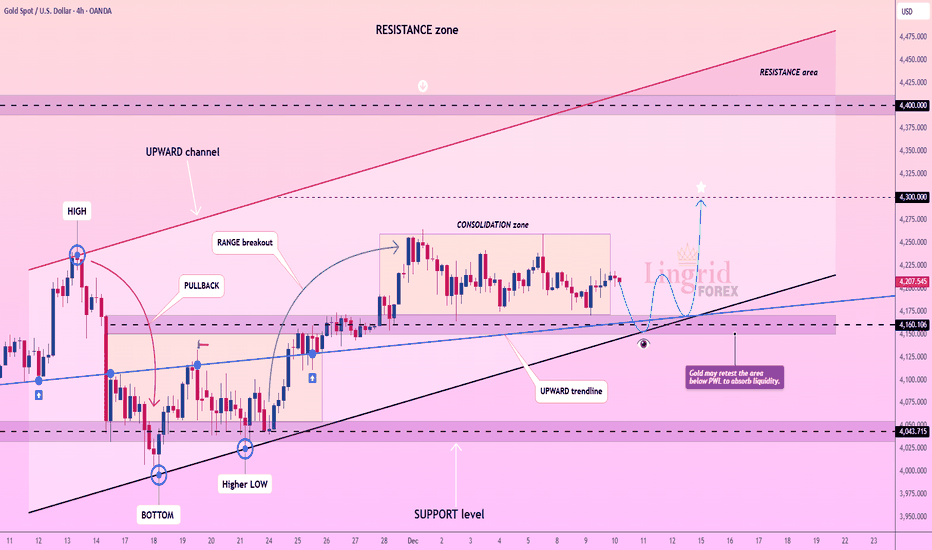

Lingrid | GOLD Sideways Movement Ahead of FOMC DecisionOANDA:XAUUSD perfectly played out my previous trading idea . Price is holding inside a well-defined consolidation after its prior surge, with price rotating above the rising channel base. The trend remains constructive, but momentum has cooled, suggesting participants are waiting for a catalyst ra

BOJ to Stress Test Global Markets? Why a Black Swan Is PossibleWhile US markets are busy debating AI valuations and parsing the Fed’s latest rate cut , something far more understated — and potentially more disruptive — is brewing across the Pacific.

The Bank of Japan is expected to raise interest rates on Friday, marking what could be its first hike in 11 mon

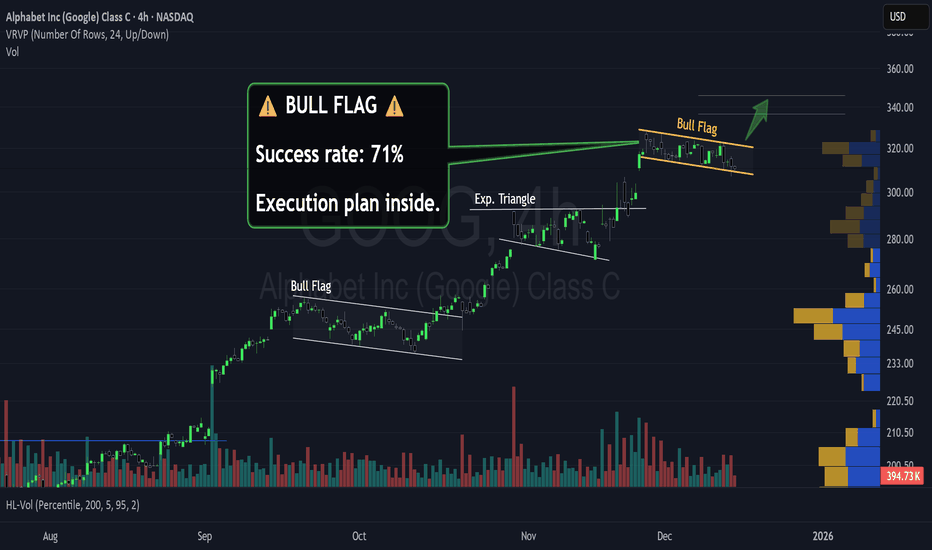

GOOG: Is a 10% Surge Imminent? The Setup for $340 Explained🚀 NASDAQ:GOOG : Is a 10% Surge Imminent? The Setup for $340 Explained

In the noisy world of trading, clarity is power.

Today, we are looking at Alphabet Inc. (GOOGL). We are not predicting the future, we are simply preparing for a high-probability outcome.

We have identified a textbook Bull Fla

DOGE pulls back before major decline DOGECOIN is in a range formed against the backdrop of a downtrend. The market is under pressure from above at 0.155 - 0.153 - 0.150. The structure is bearish. The rebound from 0.134 is directed towards 0.1415. A false breakout could trigger a decline.

There is no volume from the bulls, and the mark

See all editors' picks ideas

Multi-Ticker Anchored CandlesMulti-Ticker Anchored Candles (MTAC) is a simple tool for overlaying up to 3 tickers onto the same chart. This is achieved by interpreting each symbol's OHLC data as percentages, then plotting their candle points relative to the main chart's open. This allows for a simple comparison of tickers to tr

Vdubus Divergence Wave Pattern Generator V1The Vdubus Divergence Wave Theory

10 years in the making & now finally thanks to AI I have attempted to put my Trading strategy & logic into a visual representation of how I analyse and project market using Core price action & MacD. Enjoy :)

A Proprietary Structural & Momentum Confluence System

Per Bak Self-Organized CriticalityTL;DR: This indicator measures market fragility. It measures the system's vulnerability to cascade failures and phase transitions. I've added four independent stress vectors: tail risk, volatility regime, credit stress, and positioning extremes. This allows us to quantify how susceptible markets are

Volatility Risk PremiumTHE INSURANCE PREMIUM OF THE STOCK MARKET

Every day, millions of investors face a fundamental question that has puzzled economists for decades: how much should protection against market crashes cost? The answer lies in a phenomenon called the Volatility Risk Premium, and understanding it may fundam

Volume Gaps & Imbalances (Zeiierman)█ Overview

Volume Gaps & Imbalances (Zeiierman) is an advanced market-structure and order-flow visualizer that maps where the market traded, where it did not, and how buyer-vs-seller pressure accumulated across the entire price range.

The core of the indicator is a price-by-price volume prof

Match Finder [theUltimator5]Match Finder is the dating app of indicators. It takes your current ticker and finds the most compatible match over a recent time period. The match may not be Mr. right, but it is Mr. right now. It doesn't forecast future connection, but it tells you current compatibility for today.

Jokes aside,

Trend Line Methods (TLM)Trend Line Methods (TLM)

Overview

Trend Line Methods (TLM) is a visual study designed to help traders explore trend structure using two complementary, auto-drawn trend channels. The script focuses on how price interacts with rising or falling boundaries over time. It does not generate trade sign

Breakouts & Pullbacks [Trendoscope®]🎲 Breakouts & Pullbacks - All-Time High Breakout Analyzer

Probability-Based Post-Breakout Behavior Statistics | Real-Time Pullback & Runup Tracker

A professional-grade Pine Script v6 indicator designed specifically for analyzing the historical and real-time behavior of price after strong All-Ti

Holographic Market Microstructure | AlphaNattHolographic Market Microstructure | AlphaNatt

A multidimensional, holographically-rendered framework designed to expose the invisible forces shaping every candle — liquidity voids, smart money footprints, order flow imbalances, and structural evolution — in real time.

---

📘 Overview

The Hol

See all indicators and strategies

Community trends

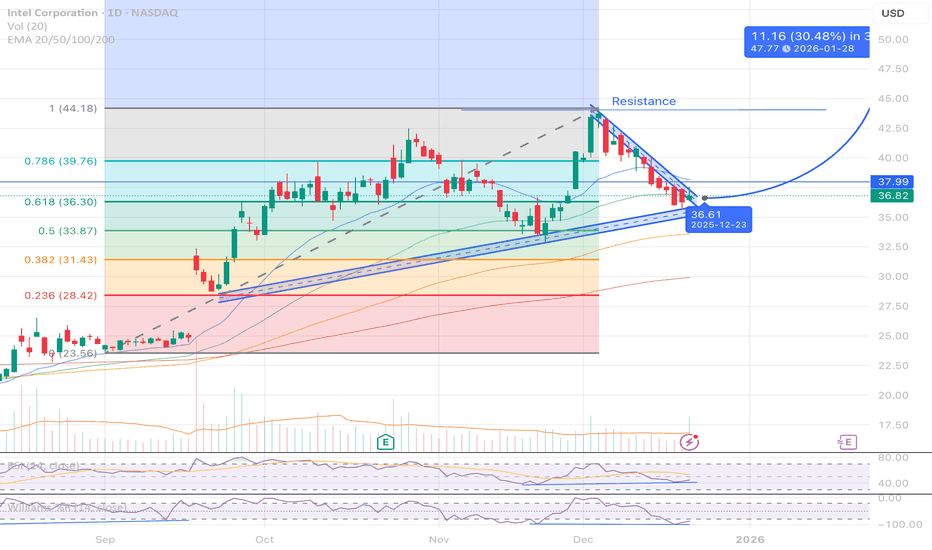

$INTC TechnicalsHere is where we stand:

- Peeking above a squeeze on the flag - continuing the uptrend.

- Needs a strong close over the 50MA ($36.89) - it was on its way on Friday, before triple witch pushed it under in the last 8 minutes of trading.

- This is the first close (yesterday) that volume exceeded aver

Impulse Wave 3 extended inside rising channel •Elliott Wave

• Impulse Wave 3 extended inside rising channel

• Current consolidation = micro Wave 4

• Wave 5 expected if structure holds

⸻

Fibonacci

Measured last impulse leg:

• 38.2% → 176

• 50% → 168

• 61.8% → 159 (last bullish defense)

Extensions:

• 1.0 → 220

• 1.272 → 245

• 1.618 →

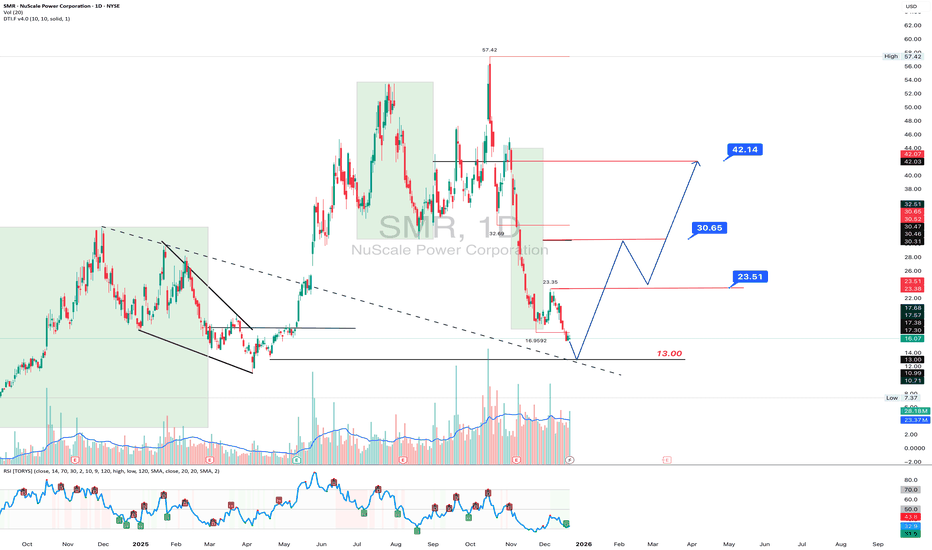

SMR 1D: Small reactors. Big nerves.I am looking at NuScale Power without emotions. After a strong impulsive move, the price is in a deep correction phase and is now forming a base. The key focus is not old trendlines, but current market behavior. On the daily chart, RSI reached oversold levels and started to turn up, while price is n

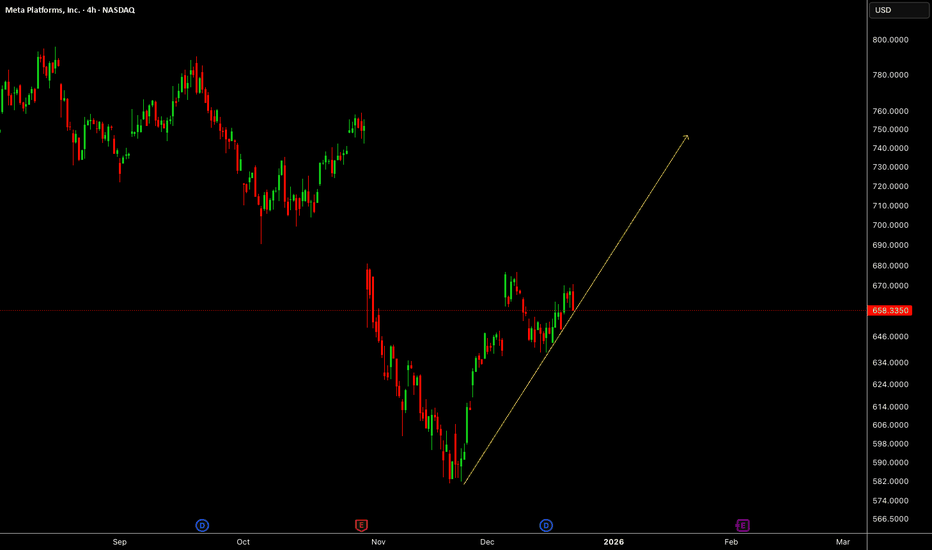

META Regains Direction as Price Rebuilds MomentumMeta Platforms is showing a constructive shift in price behaviour on the 4H timeframe after a corrective phase, with structure beginning to realign in favour of continuation. The recent recovery suggests buyers are gradually reasserting control as the market reassesses growth expectations and broade

NVDA: Structure Before StoryThere’s been a lot of talk lately and Micheal Burry questioning NVDA and news

Headlines all over the place . Opinions. Doubt. Validation-seeking from both sides of the trade.

That’s normal when price compresses this tightly under a major level.

But I want to be clear about how I’m approaching NVDA

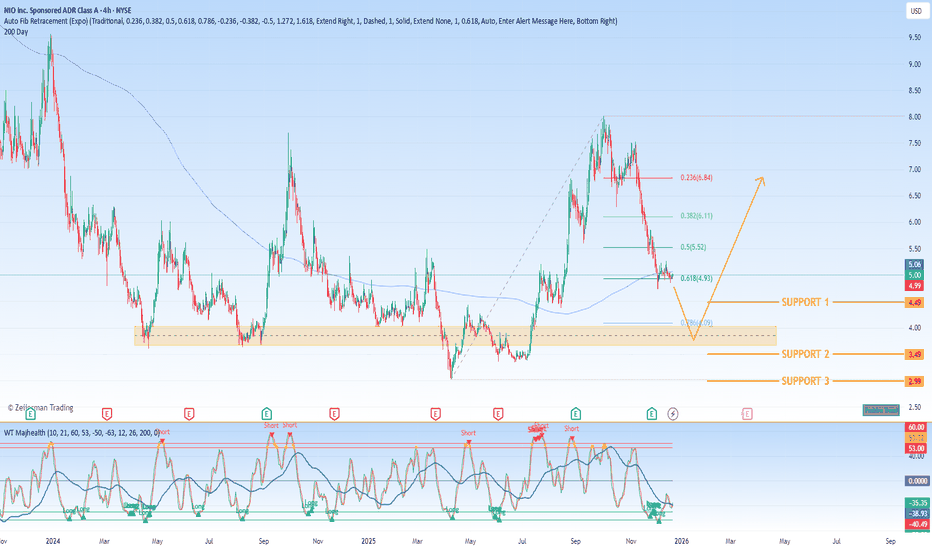

$NIO - Deep Dive into a High Growth High Volatility EV ContenderNIO Inc. stands as a prominent yet polarizing figure in the electric vehicle landscape, frequently highlighted by market observers as a fundamentally strong growth stock trading at penny stock levels. The company embodies a compelling mix of robust long-term expansion, significant near-term challeng

NVDA Daily Chart Breakdown: Trendline, Targets, and RiskNVDA remains in a strong long-term uptrend, but short-term price action shows a corrective / decision phase. Price is currently sitting on a major ascending trendline, near the 50-day SMA.

Current state:

• Primary trend: Bullish

• Price location: Key dynamic support

• Major resistance: 210 – 2

See all stocks ideas

Today

EBFEnnis, Inc.

Actual

0.42

USD

Estimate

0.41

USD

Tomorrow

USBCUSBC, Inc.

Actual

—

Estimate

−2.40

USD

Tomorrow

GTIMGood Times Restaurants Inc.

Actual

—

Estimate

—

Tomorrow

LMNRLimoneira Co

Actual

—

Estimate

−0.11

USD

Dec 31

MSSMaison Solutions Inc.

Actual

—

Estimate

0.00

USD

Dec 31

KAVLKaival Brands Innovations Group, Inc.

Actual

—

Estimate

—

Dec 31

JVACoffee Holding Co., Inc.

Actual

—

Estimate

—

Jan 1

LNNLindsay Corporation

Actual

—

Estimate

1.47

USD

See more events

Community trends

BTCUSDT: Holds Demand - Retest of 90,300 Resistance LikelyHello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT recently transitioned from a strong downward channel into a broader bullish recovery phase. After a prolonged bearish move, price formed a base near the channel low, where selling pressure weakened. This le

ETH/USD Bearish Structure with Downside TargetsETH/USD is showing clear bearish pressure after repeated failures to sustain above the highlighted supply zone around the 3,050–3,100 area. Price action indicates a lower high structure, followed by a strong rejection from the Ichimoku cloud, suggesting sellers remain in control. The cloud ahead is

Bitcoin: Won't Break Support, Back To 95K?Bitcoin continues to maintain the broader support around the low 80Ks. While this formation appears to be a lower high consolidation (bearish), it could also be the key inflection point for a reversal back into a bullish structure. This possibility aligns with the broader bullish trend which is stil

Bitcoin’s Next Move Starts Here Key Levels MappedBTC is currently in a technically critical phase. Price is trading below a major dynamic trendline resistance after a confirmed bearish break, keeping the broader structure corrective rather than impulsive. Momentum remains capped unless bulls reclaim key dynamic levels.

The plan from here is stra

BITCOIN - Manipulation and liquidity hunting before the crash BINANCE:BTCUSDT.P is stuck in the range of 85K - 90K. There is no liquidity in the market, but at the same time, the downward trend continues...

Earlier, we discussed such a nuance as the breakdown of support for the upward local trend. The global trend is bearish, and this nuance generally in

ETH Holds Support - Bulls Still in Play!?📈ETH has been trading within a rising broadening wedge pattern.

⚔️This week, price rejected the lower boundary of the structure.

🏹As long as the wedge remains intact, and ETH holds above the last major low at $2,750, a bullish continuation toward the upper boundary of the wedge remains the favo

ETHUSD – Technical Rebound Within a DowntrendHello, this is Domic.

Looking at the ETH daily chart, the current picture is quite clear: the primary trend remains bearish, and the recent upside move should only be viewed as a technical rebound.

Price is still trading below both EMA34 and EMA89, with EMA34 having crossed below EMA89 and both m

Bitcoin - Channel no one talks about! (new Year's crash!)Bitcoin's price and development (code) are completely controlled by banks and government. They already have a roadmap on Bitcoin price, so they know what the price will be in 2030. Bitcoin technology is great for total control because all transactions are public. How to profit from that? First of al

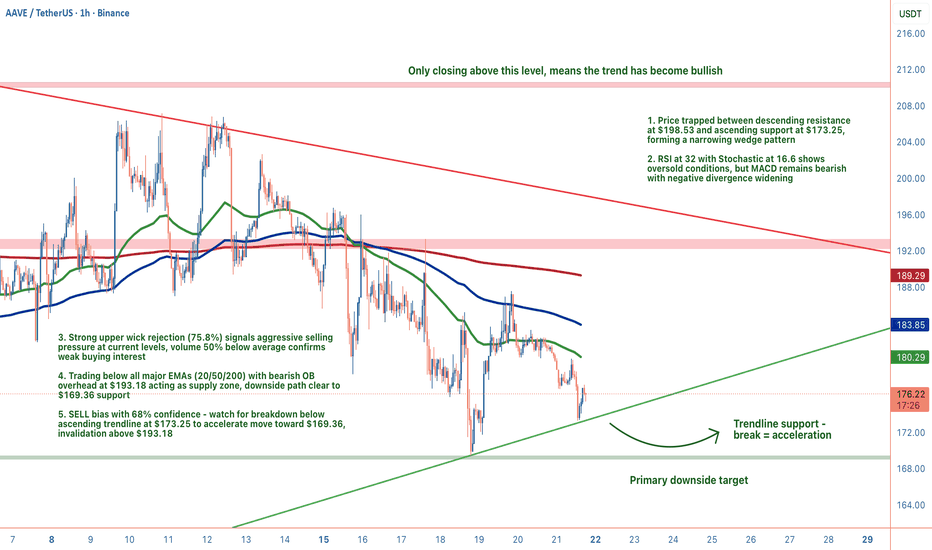

AAVE: The Squeeze Is OnWe're watching a textbook compression pattern on AAVE—price trapped between ascending support at $173.25 and descending resistance at $198.53. These narrowing wedges don't last forever. The question isn't if it breaks, it's which direction and how violently. Current price: $175.48.

1. THE TECHNICA

A continued crash to $45k for Bitcoin? - December 2025Bitcoin has 5 days to stop the current candle body print under the 11 day 50SMA. Throughout the entire history of Bitcoin, a candle body close under this level has meant a test of the 11 day 200SMA. It is that simple. Never a false signal.

Here are all the historical data points:

50SMA on the 11 d

See all crypto ideas

XAUUSD Demand Holding - Resistance Retest in PlayHello traders! Here’s my technical outlook on Gold (XAUUSD, 4H) based on the current chart structure. After a strong bullish impulse from the 3,650–3,700 area, price formed a clear ascending channel, respecting both rising support and resistance. Higher highs and higher lows continue to confirm bull

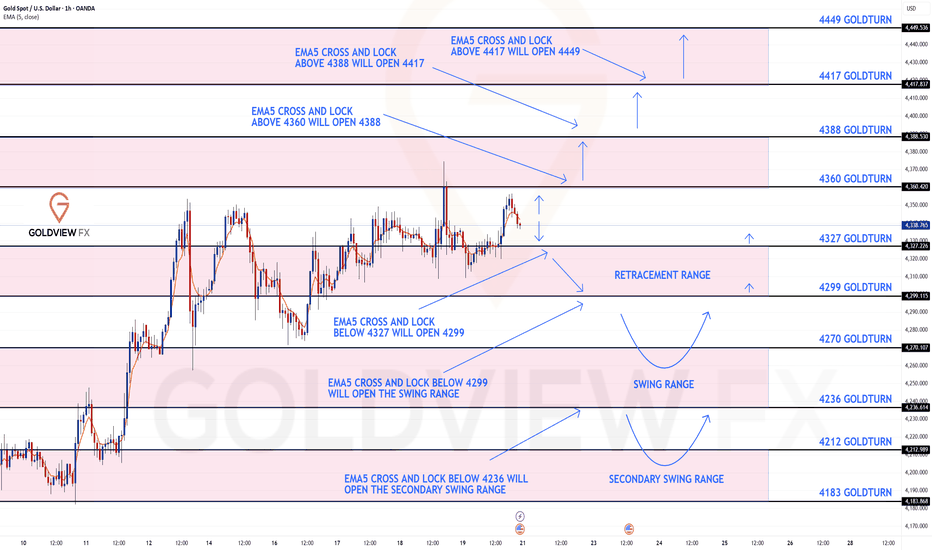

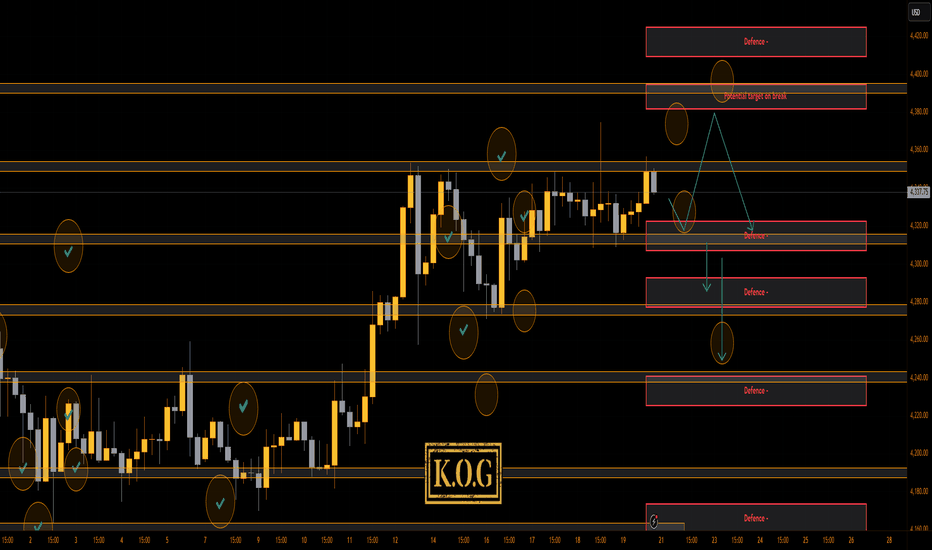

GOLD 1H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 4360 and a gap below at 4327, as support. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will se

XAUUSDHello Traders! 👋

What are your thoughts on GOLD?

Gold is currently trading near its all-time high (ATH) and the upper boundary of a short-term ascending channel.

This zone has acted as a strong resistance area, where price has been rejected multiple times in the past.

As long as price remains belo

Lingrid | GOLD Weekly Outlook: Pause Before the Next Surge OANDA:XAUUSD push toward the $4,400 psychological barrier encountered resistance, stalling just shy of a decisive breakout as market momentum softened ahead of the year-end holidays. This is not a reversal, but a classic consolidation—a necessary pause to digest gains and reset for the next leg hig

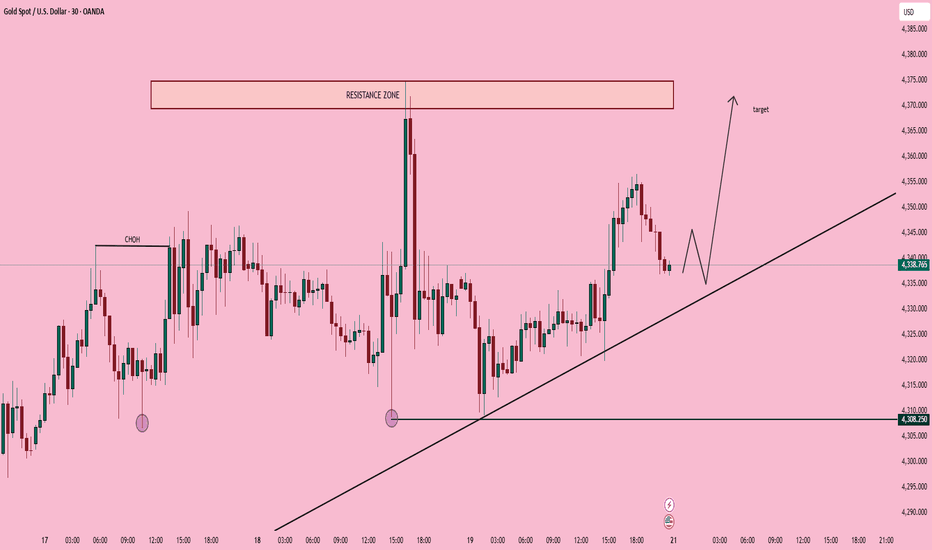

Elise | XAUUSD – 30M -Liquidity Sweep → Trend Continuation SetupOANDA:XAUUSD

The sharp downside spike into 4308 was a liquidity grab, not a breakdown. Buyers stepped in aggressively, flipping momentum and pushing price back into a controlled bullish leg. Current pullback is corrective, not impulsive — suggesting continuation toward higher resistance if structu

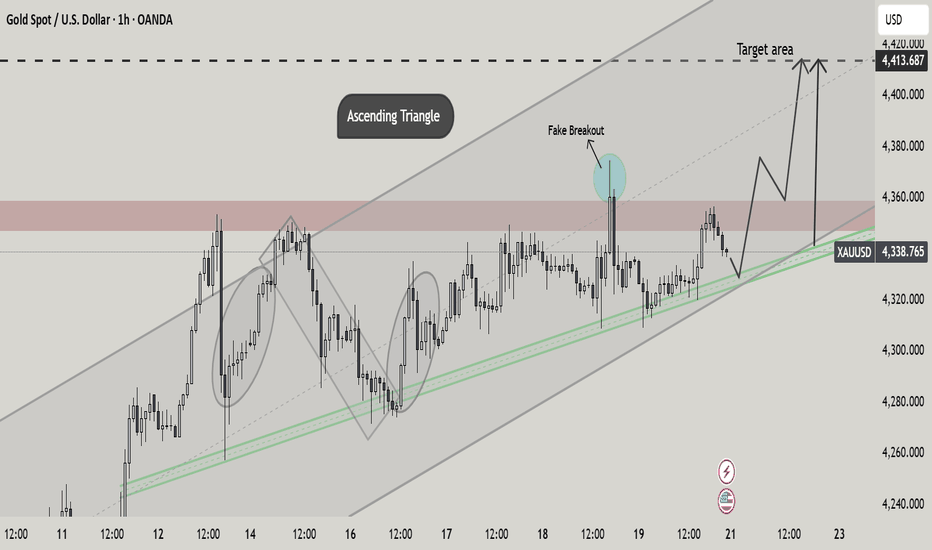

Ascending Triangle After Fake Breakout Bullish Continuation This 1-hour Gold (XAUUSD) chart shows a well-defined ascending triangle structure within a rising channel. Price continues to respect the ascending support trendline, forming higher lows while pressing against a key resistance zone.

A recent fake breakout above resistance was quickly rejected, sugg

XAUUSD (H4) – Weekly Outlook (Dec 22–26)Buy the dip inside the channel, watch for a short-term correction after Wave 5

Strategy summary for next week

On the H4 chart, gold is still trading inside a mid-term rising channel. However, the wave structure suggests Wave 5 is likely завершed, so next week I’m focusing on two main ideas:

Mid-te

XAUUSD Bullish Continuation Toward 4374XAUUSD (30M) Short Description:

Gold is holding above key support around 4335–4320 after a pullback. Price is showing bullish continuation potential, with resistance near 4357. A break and hold above resistance could push price toward the 4374 target, while major support remains around 4307.

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we again published the predictive path and expected price to stay within the range but attempt that high. We managed to follow that path nearly to the tee capturing the high, the low and then the RIP from the level of defence we had given.

A great week

Silvers Worth More than Oil! CAUTION!The last time silver traded above both oil and gold was during the Hunt Brothers’ attempt to corner the silver market (arguably the original anti-government Crypto Bros speculators with Lambos, if you think about it. LOL!)

What makes the current setup different is that this move is occurring wit

See all futures ideas

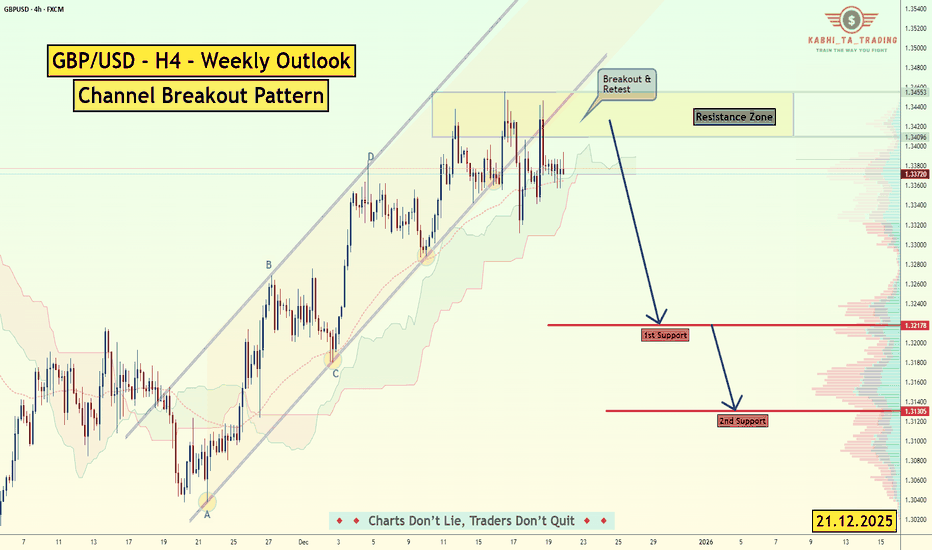

GBP/USD - H4 Weekly Outlook- Channel Breakout📝 Description 🔍 Setup (Market Structure) OANDA:GBPUSD

GBP/USD is trading inside a rising channel on H4 and has recently shown a channel breakout attempt followed by a retest near the upper zone. Price is now consolidating under a key resistance area, making this a decision week.

🔴Higher highs &

EURUSD Short: Head & Shoulders at Resistance - Target 1.1670Hello, traders! EURUSD previously traded within a well-defined Descending Channel, confirming sustained bearish pressure and controlled sell-side momentum. Price consistently respected the channel boundaries, forming a sequence of lower highs and lower lows. Multiple breakout attempts occurred withi

USDCAD – Bullish Harmonic Completion at Key SupportUSDCAD – Bullish Harmonic Completion at Key Support

USDCAD has completed a clear bullish harmonic pattern, with price reacting precisely from the D completion zone.

This pattern is increasing the probability of a technical rebound from this area.

After the strong bearish leg into point D, price

USDCAD bullish consolidation structure insideUSDCAD consolidation in a strong bearish trend for a long period, with price consistently making lower highs and lower lows. This selling pressure pushed the market down toward a major demand/support zone around 1.3750–1.3780, where price finally started to slow down.

After reaching this support ar

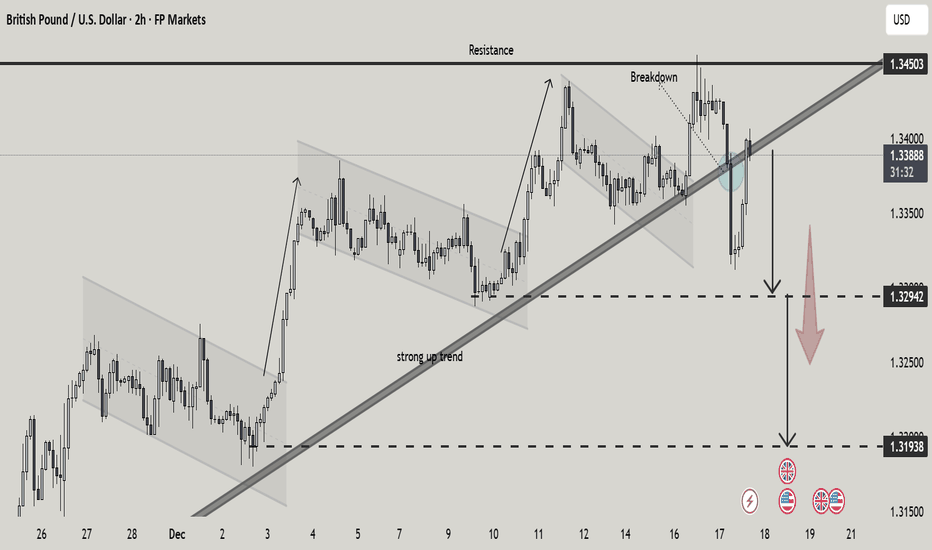

GBPUSD Trendline Breakdown Deeper Pullback from Key ResistanceThis 2-hour GBP/USD chart highlights a strong bullish structure built on a rising trendline, with price respecting higher lows throughout early December. Multiple ascending and corrective channels show controlled upside momentum.

Price recently tested a major resistance zone near 1.3450, failed to h

EURUSD Holds Demand - Retest of 1.1760 Resistance LikelyHello traders! Here’s my technical outlook on EURUSD based on the current chart structure. After a prolonged bearish phase inside a descending channel, EURUSD found a solid base near the lower boundary, where selling pressure weakened and price turned around. This reversal led to a clean breakout ab

Don’t Rush to Call the Top on EURUSDEURUSD in the late December 20–21 period is showing a clearly bullish picture , supported by both fundamental news and technical structure . This is not a euphoric phase , but rather a period where the market slows down to accumulate before making its next move.

From a fundamental perspective,

EURUSD: Rejection From Key Resistance - Support 1.1660 in FocusHello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD is trading within a broader corrective structure, and the current price action suggests increasing bearish pressure near key resistance. Earlier, the pair formed a triangle structure, where price respected bo

Lingrid | EURUSD Brief Decline Before Bullish MoveFX:EURUSD perfectly played out my previous trading idea . Price recently tagged the upper resistance band near 1.1800, printing a higher high before momentum cooled and price rotated lower into the broken range. The pullback is unfolding toward the channel border and former breakout area, which ma

EURUSD - Bullish OutlookHTF (4H):

Bullish alignment restored. Price is heading toward the HTF objective at 1.19183, showing clean momentum.

Where the untrained eye might see confusion, the trained eye sees a guided navigation road map.

Mid-Term (30M):

CHoCH confirmed — previous strong LH has been taken out, leaving direct

See all forex ideas

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - |

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.